Welcome to post three in our five-part series on strategic growth.

In the first part of this series, we introduced the figure 9.2%—the approximate rate at which your credit union must grow annually for the foreseeable future just to keep place with its peer group!

In part two, we explained how we got 9.2% as our sustainable growth rate.

In this post, we’re going to connect added aspects of WHY you need to grow. We’re diving a little deeper into the member value-add provided by credit unions that have scaled versus those that don’t.

- Why does your credit union need growth beyond simply “keeping up with the Joneses”?

- What is the impact to the CU/Members of being a member of a scaled organization versus non-scaled (smaller)?

- Who are you competing against?

- How are you going to win the member?

Hopefully, this can help you explain to board members—both new and seasoned—why so much emphasis is placed on asset growth within the credit union movement.

A Primer on CU Growth

First, let’s cover the two types of CU growth: organic and inorganic.

- Organic growth: The growth of credit union assets by earning added share of your member’s business and/or adding new members. This type of growth is highly desirable as it indicates a healthy, competitive credit union and also aligns with your core mission of serving your members’ needs.

- Inorganic growth (acquisitional growth): This is where credit unions merge, creating a larger organization, but also adding the capital of the two organizations together. Another type of inorganic growth would be credit union acquisitions of banks or bank assets – although those activities normally involve a payment drawn from capital to make the acquisition.

(We will take a deeper look at both organic and inorganic growth in part four of our series).

As we mentioned in our initial post, credit unions are member-owned financial cooperatives, which means they have relatively limited ways to raise capital to sustain that growth. But why do CUs need to grow in the first place?

Why the Need for Growth?

The need for growth is as follows:

- Your Surviving Peers are Growing Substantially – Many credit unions have already recognized this need for growth and have built a plan to survive and thrive. CUs who fail to adjust will simply fade away into irrelevance or be merged out of existence.

- Operational Efficiency – All else being equal, it costs virtually nothing to add a dollar of member assets to an existing platform. For a larger CU, fixed costs are spread over more assets resulting in lower operating expenses as a % of assets, which means more money to offer better rates, enhance services, and to enter acquisitions.

What You Need to Know About Capital

So, why can’t you just increase deposit rates and lower loan rates to “grow faster”? Well, there is an effective limiter to how fast a credit union can grow: capital—or more accurately, capital as a percentage of assets.

Capital is viewed by regulators as the cushion of money which bears the brunt of risks that go south for the organization. For this reason, regulators are VERY keen to ensure credit unions maintain adequate capital reserves as a percentage of credit union assets.

Regulators view capital as the “safety net” to cushion against risks that the credit union normally takes. your credit union’s capital ratio will drop if CU assets grow too quickly.

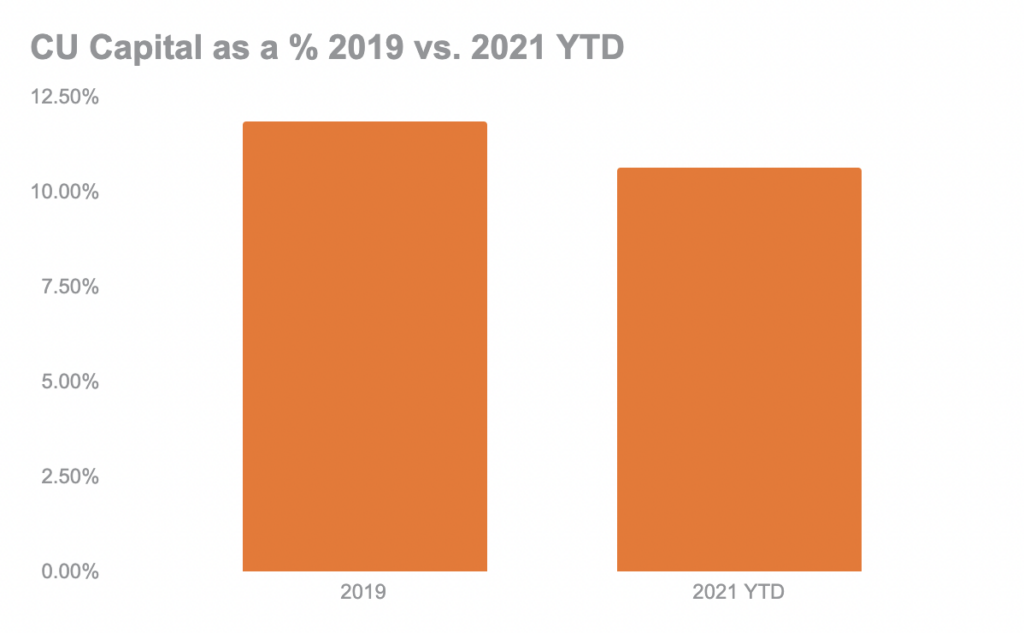

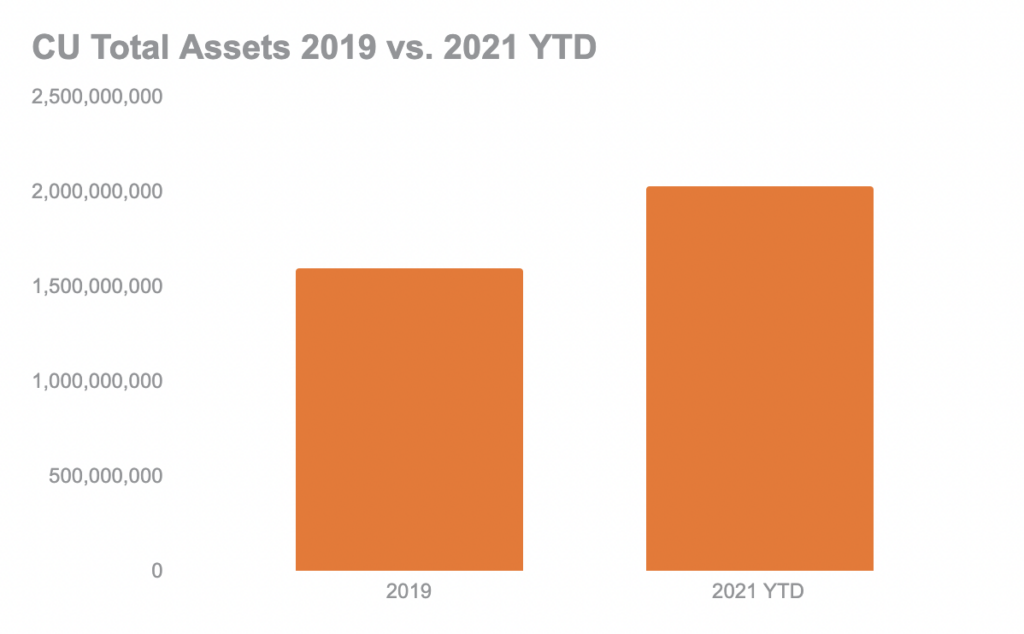

If you grow your balance sheet too quickly, you will outstrip the growth of your capital reserves. The key is knowing the “speed limit” for this growth rate (how fast can you grow without impairing your capital ratio?) and understanding how to increase this speed limit. (as we shared in our previous post – this was made evident by 2019 – 2021 changes in assets and CU percentage of capital nationwide.

Capital as a % Decreasing Over Time

CU Assets Increasing Over Time

So, how do you get your board to get on board with inorganic growth?

Getting Your Board to Look at Growth

First, present the data of the current and future market landscape to your board. Credit unions that fail to grow will fall off the wagon in a matter of years. In other words, they won’t exist or will become irrelevant.

Explaining the “why” for CU growth requires that we describe the business model of credit unions (or any financial depository for that matter).

A credit union is what is known as a “platform-based business model.” A platform business model allows parties to transact across a shared resource (or platform). In credit unions, depositors/members place funds into their account, and the credit union loans the bulk of those funds out to other member-borrowers.

Key to this type of business model is that it effectively costs $0 incremental dollars to add another dollar of deposits or dollar of loans. This means that once you build the “platform” you can add deposits, members and loans nearly infinitely without incurring a specific cost-per-unit of deposits or loans. Most internet companies are examples of platform-based business models and you know how valuable those are!

Now, there are some limitations to this model – i.e. some core processors have scale limitations, loans require underwriting, etc. but the broad concept largely holds true.

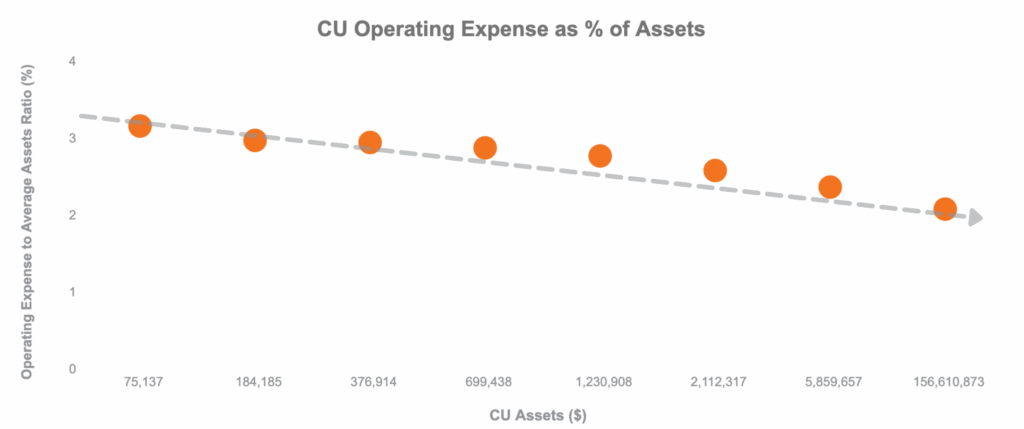

A result of this dynamic is that if all else is equal, the larger your organization, the lower your operating costs per $ of assets.

This relationship is borne out in actual CU Data regarding operating expense as a percentage of assets versus CU asset size (as seen below):

Per dollar of assets held with a credit union, a credit union with a lower operating expense has more value available to return to members, through higher dividends, lower loan rates or ancillary services.

The difference between the smallest group versus the largest amounts to 1 dollar per hundred – or over 1%.

This could be a loan rate that is 0.5% lower and dividend rate that is 0.5% higher in a highly competitive rate environment. In either case, this difference represents more value available to the scaled organization to offer their members versus the less-scaled entity.

This means more money back to your members, more competitive loan and deposit rates, and a higher ability to navigate volatile times––the definition of scale. For example, if you have $10,000 of member deposits, it doesn’t cost anything more to handle $10,100 of member deposits.

The key for boards to understand as they set the strategic direction for the credit union is unlocking the magic of the platform business model – while working with management to ensure the growth required of this model is sustainable for the long term.

The Bottom Line

Let’s recap.

In order to grow relative to peers, your CU needs to grow at greater than 9.2%, as explained in part two of our series. Many competitive CUs have already adapted to this reality, so there’s no time to waste.

Your options are as such: Grow organically or inorganically. Eventually, however, you will need to be able to sustain organic growth as the market gets smaller in number.

With fewer credit unions in operation and more credit union assets, the result is a greater average size for the surviving credit unions.

We know from data that scaled organizations in credit unions can offer added value of nearly 1% of their assets to members—simply by virtue of scale (more $ on the same fixed cost operating platform).

If you want to grow past the peer group (“gain ground”), however, you’ll need a plan to grow at greater than 9.2% per year into the foreseeable future.

You’ve weathered a difficult stretch and we applaud you for that, now, however, the real work continues.

*Note: These are estimations based on historical values. Given the COVID change in the money supply, ongoing monitoring and adjustment will need to be made to these assertions.