Attracting, retaining, and rewarding your key executives properly is crucial to the success of your bank. At Newcleus, we recognize the power of well-designed compensation. When it comes to executive compensation, however, there are various arrangements that can work in conjunction with one another; two of them being BOLI and a SERP arrangement.

BOLI can help support your executive’s SERP arrangement. We’ll discuss how below, but first, let’s give a high-level overview of BOLI and SERPs.

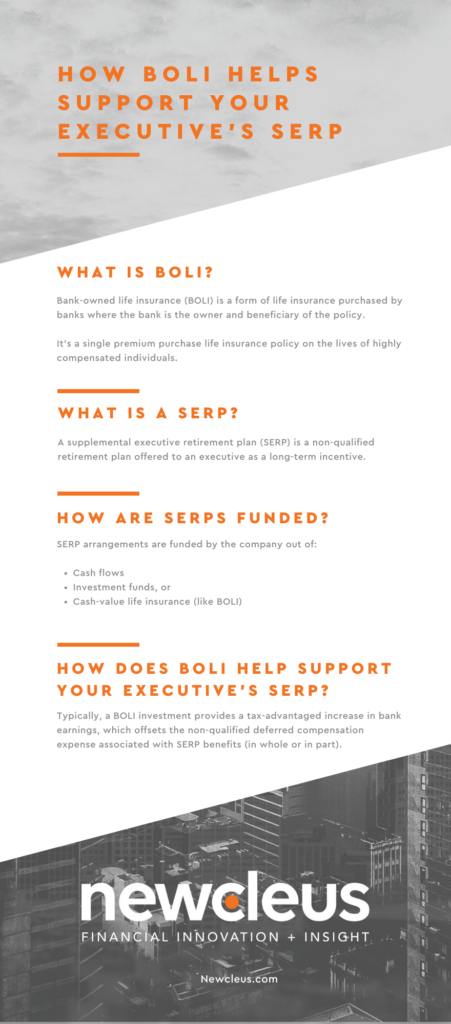

What is BOLI?

Bank-owned life insurance, more commonly referred to as BOLI, is a form of life insurance purchased by banks where the bank is the owner and beneficiary of the policy.

BOLI is a single premium purchase life insurance policy on the lives of highly compensated individuals, typically the top 35% highest-paid.

Benefits and Attributes of BOLI

- Generate tax-advantaged income to offset and recover the costs of employee benefit plans (including healthcare, group term life insurance, retirement benefits, and deferred compensation)

- Generate stable revenue from non-loan sources and enhance the other non-interest income component of the income statement

- Allow for competitive recruitment and retention by sharing a portion of returns with key executives

- 100% of the premium begins to grow on day one

- Inside build-up of the policy’s cash value is non-taxable income to the bank

- Death benefit proceeds are received tax-free

What is a SERP?

Supplemental Executive Retirement Plans, commonly referred to as SERPs, are valuable compensation tools that banks can use to attract and retain executive talent.

A SERP is a non-qualified retirement plan, typically offered to an executive as a long-term incentive. This deferred compensation arrangement is a deferred compensation agreement between the company and the key executive. In this agreement, the company provides supplemental retirement income to the executive.

SERP arrangements are non-elective, meaning the bank is responsible for contributions to the plan.

How Are SERPs Funded?

SERP arrangements are funded by the company out of:

- Cash flows

- Investment funds, or

- Cash-value life insurance (like BOLI)

How Does BOLI Help Support Your Executive’s SERP?

Banks can invest in BOLI to offset the non-qualified deferred compensation expense associated with SERPs.

Deciding to invest in BOLI as an informal financing method to offset non-qualified deferred compensation expense, however, varies on a case-by-case basis.

Below are some things to consider:

“BOLI financing can be part of or separate from the SERP negotiation process… [it] operates on a schedule of its own which depends on the number of employees to be insured. “

Typically, a BOLI investment provides a tax-advantaged increase in bank earnings. This, in turn, offsets the non-qualified deferred compensation expense associated with SERP benefits (in whole or in part). This considered, BOLI and SERP financing and preparation are fulfilled hand in hand.

Because BOLI is a large investment decision, all of the pros and cons must be weighed. Bank management is expected to be familiar with:

- BOLI products available

- The features of the BOLI

- BOLI regulatory compliance

- IRS compliance

- And more

More About What We Do

BOLI works best for banks that have excess liquidity, strong core deposits, few other tax-advantaged investments, and/or are in need of tools to retain its management team.

At Newcleus, a large portion of our business is focused on the placement of employer-owned assets: BOLI and CUOLI. We also focus heavily on putting properly designed deferred compensation plans in place for our bank and credit union executives and directors and provide compensation consulting for our customers, which is led by the Compensation Advisory division.

Read on to learn how to makes SERPs work for your employees and your bank.