It’s no surprise that many credit unions feel compelled to do what’s right. Today more than ever, diversity, equity, and inclusion (DEI) are crucial in the workplace.

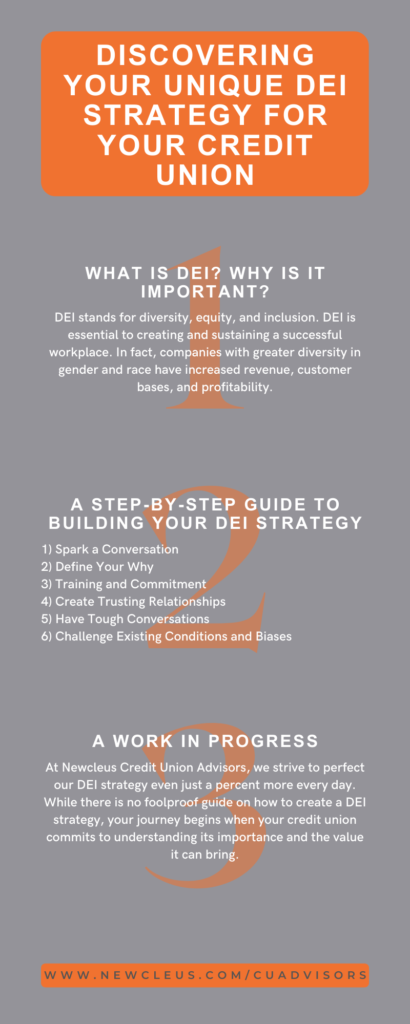

At Newcleus Credit Union Advisors, we recognize that a true DEI commitment starts with discovering your unique DEI strategy for your credit union. Here is a rundown of DEI in the workplace along with a step-by-step guide to building your strategy.

What is DEI?

As mentioned, DEI stands for diversity, equity, and inclusion. According to Built In, “Diversity is the presence of differences within a given setting. Equity is the process of ensuring that processes and programs are impartial, fair, and provide equal possible outcomes for every individual. Inclusion is the practice of ensuring that people feel a sense of belonging in the workplace.”

Why is DEI Important?

DEI is important for a number of reasons. DEI is essential to creating and sustaining a successful workplace. When employers prioritize DEI, it supports the idea that all individuals can succeed and grow both personally and professionally.

There are tangible benefits for companies that prioritize DEI. According to a study on levels of workplace diversity, done by McKinsey & Company and The Society for Human Research Management, companies who prioritize gender and ethnic diversity are “respectively, 15% and 35% more likely to outperform less diverse organizations.”

Additionally, companies with greater diversity in gender and race have increased revenue, customer bases, and profitability. Benefits for employees include “increased job satisfaction… increased levels of trust, and higher engagement levels… [While] DEI programs lift morale and overall attitude on an employee level, they also provide a multitude of benefits that can be seen at every level of the business.”

In comparison, companies who ignore the recommendation to prioritize DEI, fail to fully unlock their employees’ potential. According to a study by Unrealized Impact, “Diverse teams are more innovative and make better decisions, and diverse companies have better shareholder returns.” And who doesn’t want better decision-making or shareholder returns in their company?

Looking forward, DEI is expected to be a part of any company’s fundamental structure. Today, it is not enough to discuss the history of injustice and underrepresentation within the workplace. Employers must actively work to create significant change by integrating a DEI strategy into their organizations.

Despite the importance of DEI and its long list of benefits, however, many organizations struggle to know what steps to specifically take to implement a culture of diversity, equity, and inclusion.

A Step-by-Step Guide to Building Your DEI Strategy

Step One: Spark a Conversation

Start with the basics. Why is DEI important for your credit union? What value can be brought to the table when an increase in diversity takes place?

Step Two: What’s Your Why?

Are you pursuing DEI in your credit union for the purpose of values and ethics, a desire for growth, or to address fluctuating demographics in your field? Whatever your reason, the leaders of your credit union should be able to properly articulate it.

Step Three: Training and Commitment

As the adage goes, practice makes progress! With proper training, board members will have a foundational knowledge of how DEI affects company growth, the potential pitfalls of biases, and the basics of changing demographics.

Next, make a formal, public commitment to your DEI strategy. This could include a number of actions like endorsing a diversity statement or signing a pledge, the list goes on.

Step Four: Create Trusting Relationships

Allow board members to become acquainted with one another through a variety of different social interactions. This will ensure things run more smoothly down the line when the need to have difficult conversations occurs.

Step Five: Have the Tough Conversations

As you pursue your DEI efforts, chances are you’ll run into tough conversations. Stand tall and address each concern as it presents itself.

Once your credit union has become diversified, you additionally might want to prepare for a higher level of engagement or even push back. This is expected, however, when you onboard various people with different backgrounds and life experiences.

Step Six: Challenge Existing Conditions and Biases

Lastly, be conscious of any unconscious bias. You will watch your credit union thrive when its board members openly address wonky or outdated practices.

Robert Camarillo, Ironworkers USA Board Chair, for example, states: “I want to see credit unions become more diverse and inclusive from their boards of directors to their senior leadership.”

Camarillo states that on many occasions he has addressed the fact that he is the only person of color in the room. He continues, “Black, Indigenous, and people of color are still underrepresented, and we must ask why.”

And we, as credit unions, need to sit in these uncomfortable questions and ask ourselves why as well, then formulate plans to create our own DEI strategy to combat underrepresentation.

A Work in Progress

No matter your race, gender, ethnicity, or so on, every individual should feel valued, supported, and seen in the workplace at all times. At Newcleus Credit Union Advisors, we strive to perfect our DEI strategy even just a percent more every day.

DEI in the workplace is something that, after all, companies should always be prioritizing. It is a never-ending process and evolving facet of life and business. And while there is no foolproof guide on how to create a DEI strategy, your journey begins when your credit union commits to understanding its importance and the value it can bring to the workplace.