What steps can your CU take to achieve sustainable growth?

Growing your credit union is essential, and the first step toward this goal is for your board and management team to appreciate the importance of achieving sustainable growth for your Credit Union. For starters you’ll need to:

- Adopt a minimum long-term growth rate of 9.2%

- Set strategic goals that align with achieving this level of growth – either organically or through merger/acquisition

- Operate efficiently and focus on doing more with less

Minimum Growth

Using estimated industry assets, money supply and the trending drop in the number of credit unions, we have arrived at 9.2% as an estimated minimum growth rate for credit unions to remain competitive in the future. Just to keep pace with the growth of the average credit unions that are expected to survive in the future, your organization must adopt a minimum growth rate of 9.2%. If you want to gain ground relative to surviving peers, you will actually need a plan to sustainably exceed that growth rate.

Manage Expenses

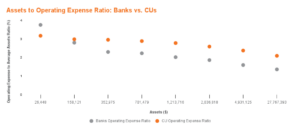

If you were to ask credit union CEOs or industry pundits, almost all would agree that credit unions tend to operate inefficiently. As a general rule, credit unions have higher operating expenses relative to assets.

Find in the graphic above where your credit union lies among other banks and credit unions in the marketplace in terms of operative expenses per asset size. Knowing where you stand in the industry will help you measure improvement as you progress toward your credit union’s goals.

Adopt a Productivity Culture

The pandemic forced credit unions to move quickly to make changes, adopt efficiencies and identify innovative ideas. Productivity was measured as adaptations were implemented, suggesting that now is a perfect time for workplace changes to be evaluated.

For example, recent research shows that a highly productive employee will generate approximately 4.8 times more value to the enterprise than an employee of average productivity. In other words, you could produce the same value with half the number of employees by using highly productive employees.

Generate Additional Revenue

A majority of credit unions are not using all of the tools available to them that could add incremental revenue. Charitable donation accounts (CDA), fintech partnerships, alternative investments and deferred compensation plans are all potential revenue-generating options.

Charitable Donation Accounts – “The Best Kept Secrets in Credit Unions”

Every year, credit unions miss out on $180 million of value because they are not using charitable donation accounts. A CDA would allow a credit union to maintain its current charitable giving and generate interest to offset everyday credit union expenses.

“By using the CDA, the credit union can provide current or additional charitable donation value through excess investment returns,” said John Moreno, Managing Partner, Newcleus Credit Union Advisors. “In most cases, the credit union is also able to recoup the investment return it would have generated on the funds absent the CDA – so it can truly become a win-win.”

Fintech Partnerships

Partnerships with fintechs can give credit unions the ability to be more nimble and cutting edge and offer other competitive products and services. A successful partnership can supercharge your ability to grow your loan base, generate additional income streams and position your organization for future success.

Special due diligence is required, though, to ensure the interests of the fintech and the interests of your credit union members are best served.

Alternative Investments

Alternative investments with higher yields can mean added income to help credit unions offset traditional benefit expenses.

These investments can generate additional returns, and, in turn, help cover the cost of employee benefit plans. These often very specialized alternative investments demand more than a one-size-fits-all approach. That’s where Newcleus Credit Union Advisors helps credit union stakeholders understand the options available, compare the choices and make prudent recommendations for the specific credit union.

Deferred Compensation Plans

Your management team is the key to meeting your credit union’s strategic goals. You’ll need to ensure that they’re compensated competitively and that they will want to actively contribute for the long term.

Newcleus Compensation Advisors has helped hundreds of management teams and boards establish key performance indicators, manage compensation and performance incentives and position compensation around the factors that will drive organizational success.

Your team is in place, and performance goals are set. Ensuring continuity and retention is key. Our expertise is in balancing executive performance, accountability and the risks/rewards of compensation plan designs.

Your Growth Plan in Steps

- Establish growth as a key performance indicator. Organic or inorganic, long-term, growth is going to have to be sustainable at 9.2% or higher to remain relevant.

- Two key components to improving income and expenses:

- credit unions that compensate higher and create environments where employees can be highly productive are able to do more with less.

- If there’s an opportunity to do something more efficiently and safely, like a CDA, you need to be exploring that.

- Properly designed compensation and deferred compensation plans retain key executives and avoid the expense of turnover. Great compensation plans also hold executives accountable for growth objectives.

An inspired workforce is a productive one. At Newcleus Credit Union Advisors, we help our client credit unions adapt to this mindset by using corporate social responsibility, charitable donation accounts, online resources and compensation options to build sustainable growth and a workforce for the future.

For more information about our suite of services, contact a Newcleus Credit Union Advisor here.