The most common way credit unions recruit board members—the annual call for nominations and/or word-of-mouth from current directors and staff—is the least effective, according to Jeff Rendel, CEO of Rising Above Enterprises.

So, how can you use other strategies to effectively attract new board members to your credit union board of directors?

Let’s dive in.

Who Makes Up a CU’s Board of Directors?

Firstly, it’s important to understand the basics of how a credit union board of directors works.

Credit unions are member-owned financial cooperatives. This means you participate in a virtuous circle where member-owners are also the customers of the organization.

This considered, CUs are democratically controlled, “run by a volunteer board of directors elected by and from the membership.” Every decision made relates back to the members’ best interests.

The individuals who make up a credit union board of directors are likely just your Average Joes (which is all the more reason to ensure this group is highly diversified).

Why is Having a Diverse Board Important?

Credit union boards are supposed to mirror their communities. Therefore, making direct efforts to increase CU board diversity is essential. Simply waiting for candidates to walk through the door will not cut it in terms of recruitment.

According to an article by American Banker, “the days of self-nominating friends of current board members need to end, as that practice tends to perpetuate non-diverse boards.”

Instead, boards need to be actively seeking out candidates who are diverse in:

- Age

- Gender

- Income

- Race

- Experience

Recruiting a diverse board includes facing the facts. Today, Millennials are the nation’s largest age group—even surpassing Baby Boomers. According to the Pew Research Center, Millennials are also one of the most diverse generations in our history.

Having a diverse credit union board is so important as it will help its organization remain competitive, serve the needs of its market, and grow, according to CUInsight.

“If credit unions take a proactive approach to recruiting such talent, and develop a welcoming culture that values their insights, then they will unlock their amazing potential and get a competitive advantage,” writes CUInsight. “Be patient, be persistent, and make the necessary changes, because they will be worth it.”

After all, a more diverse board of directors won’t recruit itself.

How to Attract New Board Members

So, how can you attract new board members to your credit union board of directors? Well, research shows that less than a quarter of credit union boards sees their recruitment efforts for directors as very effective.

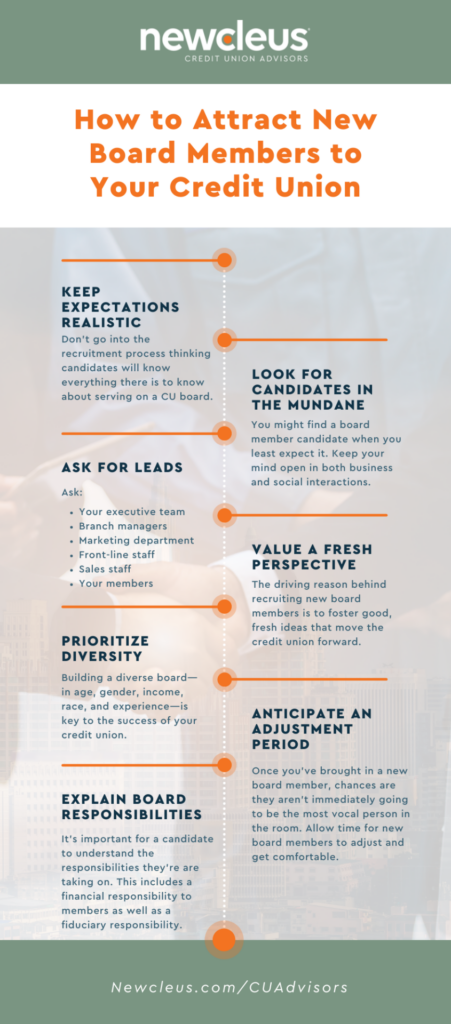

In an effort to combat this statistic, we’ve listed eight tips to help you attract new board members below.

Keep Your Expectations Realistic

As we mentioned, board members are typically just your Average Joes. This considered, don’t go into the recruitment process with the expectation that candidates will know everything there is to know about serving on a CU board.

Look for Candidates in the Mundane

You might find a board member candidate when you least expect it. Keep your mind open in both business and social interactions.

Ask for Leads

This one is a bit of a no-brainer. Ask everyone for leads, including:

- Your executive team

- Branch managers

- Marketing department

- Front-line staff

- Sales staff

- Your members

Value a Fresh Perspective

As Rendel says, “the driving reason behind recruiting new board members is to foster good, fresh ideas that move the credit union forward.” Put your ego aside and embrace “freshness” in your search for candidates.

Prioritize Diversity

As we mentioned above, building a diverse board is key to the success of your credit union.

Anticipate an Adjustment Period

Once you’ve brought in a new board member, chances are they aren’t immediately going to be the most vocal person in the room. Allow time for new board members to adjust and get comfortable.

Pro-tip: A great way to make newcomers feel more comfortable is to maintain an open-door policy. This way, new board members can ask credit union executives and staff for their expertise.

Ensure Candidates are Capable and Understand Board Responsibilities

Prior to bringing on a new board member, ensure they know what they’re getting themselves into.

As one considers becoming a board member, it’s important to understand the responsibilities they’re are taking on. This includes a financial responsibility to members as well as a fiduciary responsibility.

Mark Werner, Board Chairman at Quorum Federal Credit Union says, “typically we look for existing members of the credit union to become part of the board.” Why? Because understanding the basic concept of a credit union is key.

Previously, Werner contacted members with little to no credit union background, and the biggest hurdle became understanding the concept of a credit union.

Moreover, ensuring candidates clearly understand their potential role will help reduce turnover.

Be Patient

When attracting new board members, patience is key. Although a prospect may be qualified, they also might be busy. Express your interest in them, then remind them periodically that your offer still stands.

A Final Word

Kienan Shaw of Credit Union National Association (CUNA) puts it best when it comes to a credit union’s success: “It is vital for board members to stay informed on current events and hot topics affecting the credit union world.”

Attracting new and diverse board members to your credit union board of directors is essential to staying informed and keeping CU management fresh—which will, in turn, strengthen strategic planning and overall credit union operations.

Interested in learning more? Read our article to discover what every credit union board member needs to know.